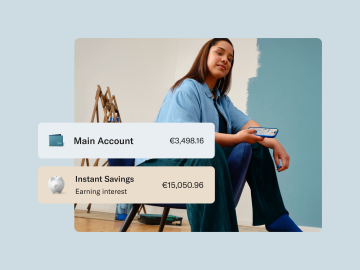

N26 Instant Savings account

Earn interest on your money

Looking to make your money work for you? Here’s another reason for you — and your money — to love N26. Grow your savings with 4%* interest rate p.a. with Metal and 2.8%* p.a. with other N26 memberships, and access your funds at any time.

This offer is available at no extra cost in the N26 app in Belgium, Estonia, Finland, Greece, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Portugal, Slovakia, and Slovenia.

*Interest rates p.a. are equivalent to AER in Ireland and TANB in Portugal (before taxes). The interest rates are based on N26 Membership: 2.8% p.a. for Standard, Smart, and You, 4% p.a. for Metal. The interest rates are variable and can be subject to change in the future.

N26 accounts — Your money deserves an upgrade

N26 Metal

The premium account with a metal card

- 4% interest p.a. on your Instant Savings

- Up to 8 free domestic ATM withdrawals

- Exclusive mobile phone coverage

N26 You

The debit card for everyday and travel

- 2.8% interest p.a. on your Instant Savings

- Up to 5 free domestic ATM withdrawals

- Flight and luggage delay cover

N26 Smart

The bank account that gives you more control

- 2.8% interest p.a. on your Instant Savings

- Up to 10 Spaces sub-accounts

- Customer support hotline

N26 Standard

The free online bank account

- 2.8% interest p.a. on your Instant Savings

- Up to 3 free domestic ATM withdrawals

- Free payments worldwide

What is N26 Instant Savings?

N26 Instant Savings is an easy-access savings account available at no extra cost for all eligible N26 customers in the countries mentioned above.

Earn interest on all your savings with no deposit limits** and instantly withdraw anytime. Win-win.

Saving just got more rewarding

Interest paid monthly

Earn up to 4%* interest p.a. — calculated daily and paid out monthly — to grow your balance automatically.

100% flexibility

No need to lock your money away. Deposit and withdraw any amount, anytime, in seconds.

No extra fees

Open your N26 Instant Savings account with just a few taps in the N26 app — at no extra cost.

No deposit limits**

Add as much money as you like and earn interest on your total savings balance. The sky’s the limit**.

Interest Calculator

N26 Instant Savings

Use our interest calculator to see how your money can grow over time with N26.

Enter your starting balance and a time period:

To choose the best savings option for you, consider the conditions of promotional rates — including how long they're valid for. The calculation above shows gross amounts before withholding taxes and assumes that the daily balance in the savings account remains the same during the whole period. If you keep the paid interest in your N26 Instant Savings account, the total gross interest earned during the whole period will be higher. This is because you'll be earning interest on the interest you've already earned.

Start earning interest

Opening your N26 Instant Savings account is easy.

Simply head to the ‘Finances’ tab in the N26 app on your phone and tap on ‘Instant Savings’ to create your savings account.

Your money is protected

N26 is a fully-licensed German bank. That means the money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

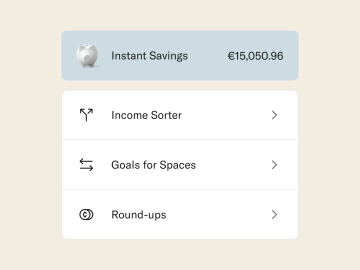

Automate? Great.

Growing your money is even easier when you automate your savings. With N26 Rules and Goals (available for all customers) or N26 Income Sorter and Round-ups (available for N26 Smart, You, and Metal customers) you can reach your goals faster by automatically moving money between your main account and your savings account. It’s a great, hands-off way to kickstart your savings.

**The money in your bank accounts — including N26 Instant Savings — is protected up to €100,000 by the German Deposit Guarantee Scheme.

The offer is provided under the German law.

Why can’t I find Instant Savings in my N26 app?

Make sure you have the latest version of the app installed. If you don't see Instant Savings in your Finances tab, you might not meet some of the eligibility criteria.

Who's eligible for N26 Instant Savings?

To create a savings account, customers need to have a personal N26 bank account, German IBAN, and T&Cs and legal residence in the following countries: Belgium, Estonia, Finland, Greece, Ireland, Latvia, Lithuania, Luxembourg, the Netherlands, Portugal, Slovakia, and Slovenia.

Is an N26 Instant Savings account only available to new customers?

No, N26 Instant Savings is available to all eligible customers — new and existing.

Are these interest rates only offered for new customers?

We offer a 4% annual interest rate for our Metal accounts, and 2.8% with other accounts. These interest rates apply for all eligible customers, new and existing. Please note that regular rates per membership are variable and subject to change over time.

When and how is my interest paid?

The gross interest you earn is automatically calculated and paid into your Instant Savings account on the first day of the following month.

How is my interest calculated?

Your interest is calculated daily based on your account balance. For instance, if you maintain a daily balance of €15,000 in your Instant Savings account for 12 months and you have Metal membership, you’ll earn a total gross interest of €600 before taxes. Similarly, if there are 30 days in a month and your Instant Savings account balance remains at €15,000 for the whole month, you’ll earn a total gross interest of €49.32 (€15,000 x 4% x 30/365) for that month.

Where can I find N26 Instant Savings in the app?

Whether you have a free N26 account or a premium one, you can find Instant Savings in the Finances tab of your N26 app under the “Savings” section. If you’re an eligible N26 customer but can’t see the Instant Savings option, please make sure that you have the latest version of the app.

Is there a limit on the amount of money I can deposit into my N26 Instant Savings?

You may deposit as much money as you like into your savings account: you’ll earn interest on the total balance of your Instant Savings account. The sky’s the limit.**

What happens if I make a withdrawal before the end of the month?

N26 Instant Savings is a fully flexible, easy-access savings account, so there are no penalties for withdrawing part — or all — of your funds before the end of the month. You won’t lose any interest that was already paid out or the interest you’ve accrued over the previous days of the current month.

Do I have to top up a certain amount of money every month to keep earning interest?

No! N26 Instant Savings is a fully flexible savings account, so you can deposit any amount any time — no strings attached.

Do I need to pay taxes on my earned interest?

Yes. In general, the interest you earn in your N26 Instant Savings account is taxable in the country where you are a tax resident. N26 won't withhold taxes from the interest you earn, so check the tax regulations in your home country and plan accordingly. For accounting purposes, you'll be able to view your total interest earned in your N26 Instant Savings balance statement. Please note that if you move to Germany, German withholding tax requirements will apply.

Can N26 Business customers open an Instant Savings account?

At the moment, only customers with a personal N26 bank account are eligible to open an Instant Savings account.

What is an easy-access savings account?

An easy-access savings account is a savings account without a strict commitment and no fixed length of deposit. This means you can deposit and withdraw money at any time without reducing your interest rate or paying penalty fees for early withdrawals.

How many savings accounts can I have?

At N26, each customer can have one Instant Savings account. There's no limit to the number of savings accounts you can have with different banks, unless there are local restrictions in your country of residence.

What’s the difference between my savings account and my main account?

Your main account is a checking account used for everyday transactions and payments, but the money in it doesn't earn interest. A savings account allows you to earn interest on the money you deposit into it, but it can't be used for everyday payments or be linked to a card.

What is the difference between a flexible savings account and a long-term or fixed-term savings account?

With a flexible savings account, you can deposit and withdraw money at any time, without reducing your interest rate or paying penalty fees for an early withdrawal. With a fixed-term savings account, you have to lock your money away for a certain period of time — usually, at least one year. If you decide to withdraw money from a fixed-term savings account during this period, you won’t get the earned interest and may have to pay a fee, depending on the T&Cs.

Can I transfer money directly from my Instant Savings account?

No, you'll need to move money from your N26 Instant Savings account to your main account first.